Selling rental property tax calculator

A combination of high property tax rates and high home values in northeast New Jerseys Bergen County means that the median property tax bill is more than 10000 the highest the US. If your taxable income is 496600 or more the capital gains rate increases to 20.

Rental Property Calculator How To Calculate Roi

Generally any profit you make on the sale of a rental property is taxable when you.

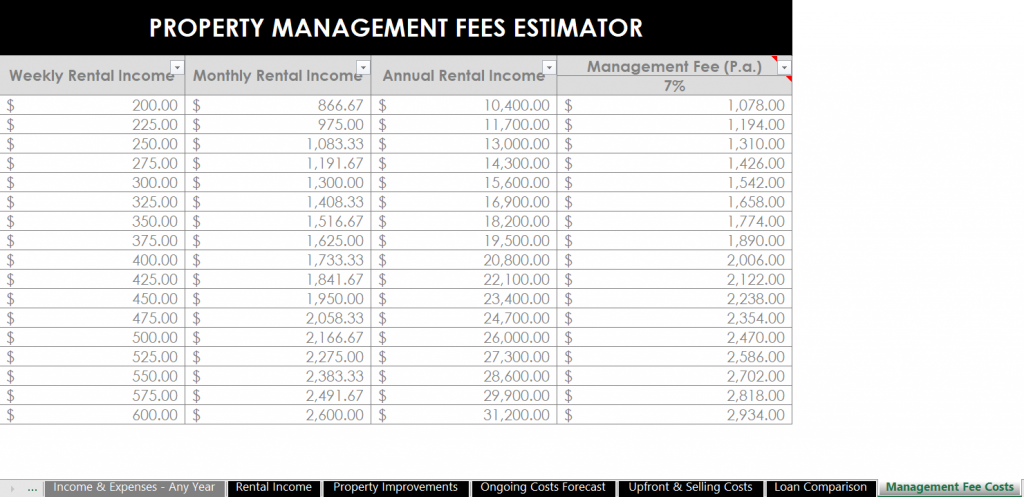

. You were domiciled and maintained a primary residence as a homeowner or tenant in New Jersey. This means that if the marginal tax bracket youre in is 22 and your rental income is 5000 youll end up paying 1100. Selling overseas property Work out your gain Your gain is usually the difference between what you paid for your property and the amount you got when you sold or disposed of it.

Also the buyer pays your portion of the current property tax. This tool will help you calculate the Tax amount you have to pay when selling a Property in UK. Property 5 days ago Capital Gains.

After some time the investor sells the duplex for 750000. Use the rent calculator below to estimate the affordable monthly rental spending amount based on income and debt level. 1 For a married couple filing jointly with a taxable income of 280000 and capital gains of.

You are eligible for a property tax deduction or a property tax credit only if. 1813 W 7th St Piscataway NJ 08854 is a single-family home listed for-sale at 449000. Use this tool to estimate capital gains taxes you may owe after selling an investment property.

That means the propertys adjusted cost basis is 200000 the purchase price minus the total depreciation taken. Rental income is taxed as ordinary income. How to Calculate Capital Gains Tax on Rental Property.

Selling Price of Rental Property - Adjusted Cost Basis. Home is a 3 bed 20 bath property. Your Annual Pre-Tax Income.

Selling Price of Rental Property - Adjusted Cost Basis. Buy calculator is a tool to help you compare the cost of renting or buying a home over time. The tax rate can vary from 0 to.

Your Monthly Recurring Debt. Capital Gains x. Capital Gains x Tax Rate Depreciation x 25 Tax Rate.

Heres the math we used to. Because buying a home is one of the biggest financial decisions you. View more property details.

When you sell the property for 997000 deduct the 55 in real estate commissions you pay or 54835. This handy calculator helps you avoid tedious number-crunching but it should only be used for. D is the cost of the depreciable assets acquired with the property E is the capital works deductions F is the legal fees 750000 30000 6000 12000 35000 10000.

Rental Property Calculator Most Accurate Forecast

How Much Is The Capital Gains Tax On Real Estate Ramseysolutions Com

Pin On Financial Ideas

2022 Real Estate Capital Gains Calculator Internal Revenue Code Simplified

Calculating Returns For A Rental Property Xelplus Leila Gharani

Rental Property Calculator Most Accurate Forecast

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

How To Calculate Rental Income The Right Way Smartmove

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

Calculating Returns For A Rental Property Xelplus Leila Gharani

Are Closing Costs Tax Deductible On Rental Property In 2022

Converting A Residence To Rental Property

Tax Calculator For Rental Property Cheap Sale 53 Off Www Ingeniovirtual Com

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

Rental Property Is Now The Right Time To Sell

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

How To Calculate Fl Sales Tax On Rent